Umbrella Insurance Policy Coverage

The Umbrella policy shields you from having to pay when you’re found at fault. What a personal umbrella policy may cover:

- A lawsuit settlement results from an accident at your home, yard or pool.

- Damages or medical expenses a guest incurs from an injury at your home.

- Damages you cause to someone else’s property, such as accidentally

- crashing a car into someone’s home.

- Defamation judgments

What a personal Umbrella policy does not cover:

- Your personal property

- Disputes about contracts

- Businesses

- Intentional or criminal acts

The premium for an umbrella insurance policy may be less expensive if the policy is purchased from the same insurer who provided auto or home insurance for you. Umbrella insurance will also cover your legal expenses and loss of income while preparing your legal defense.

Contact Us Today

A personal umbrella policy may benefit almost anyone who wants liability coverage beyond the limits of their underlying insurance policy, such as auto, home or renters. Contact a local agent for more details regarding umbrella insurance in Leduc and help determine whether a PUP is a good option for you.

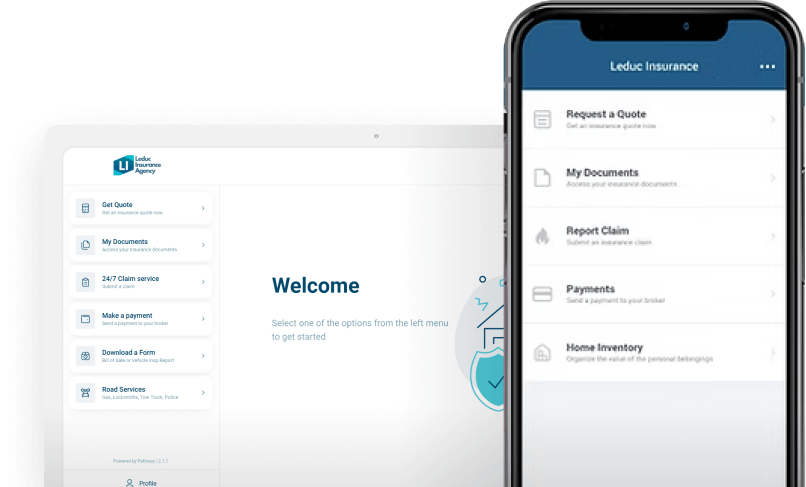

Get a Quote

Looking for home, auto, or business insurance in Alberta? Start your free quote now—quick, easy, and no obligation.

Make a Payment

Paying your premium is easy. Whether its directly through your insurance company or through us, stay on top of your insurance without the hassle.

Contact Us

Questions? Need to make a change to your policy? Our team is here to help—reach out by phone, email, (support@leducinsurance.com), phone 780-986-8424 or through our contact form.