What Does Cyber Insurance Cover?

We offer advanced cyber liability policies that include protection for:

- Cyber Attacks – Recover lost or damaged data, restore compromised systems, and get back online faster.

- Cyber Extortion – Covers ransom demands and expert response if hackers threaten your systems or data.

- Data Breaches – Pays for services when sensitive third-party personal data is compromised.

- Online Fraud – Financial protection for scams or phishing attempts that cause direct losses.

- Legal Costs – Coverage for defense in cases of digital defamation or privacy violations.

Cyber insurance helps protect everything from credit card information and SINs to health records, driver’s licenses, and proprietary business data.

Why Your Business Needs Cyber Insurance

Cyber threats can impact businesses of any size and in any industry. Traditional property and liability policies often don’t cover these digital risks. Here’s where cyber insurance steps in:

- Hacking & Cyberattacks – Prevent financial losses from system breaches or shutdowns.

- Data Leaks & Identity Theft – Protect your customers’ sensitive information and avoid legal penalties.

- Payment Data Exposure – Shield your business from the fallout of lost or stolen credit card details.

- Downtime – Recover lost income from business interruptions caused by cyber incidents.

- Reputation Protection – Help cover the cost of PR, communication, and trust rebuilding after a breach.

- Third-Party Liability – Cover damages if partner or customer data is lost due to your systems.

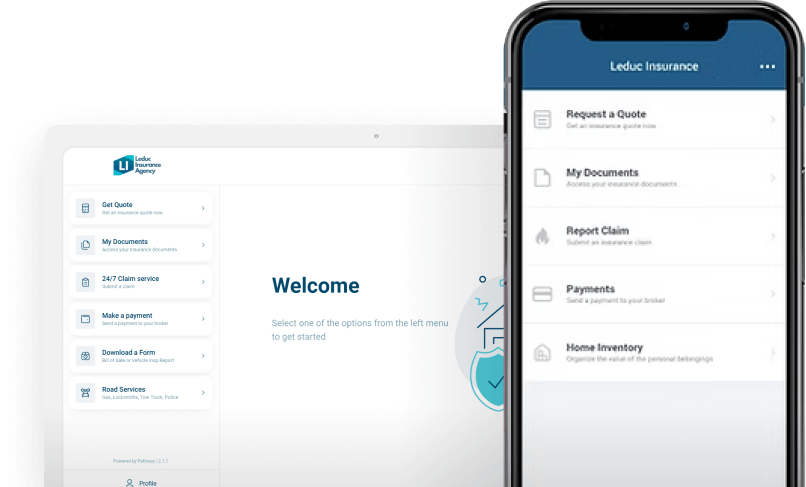

Get a Quote

Looking for home, auto, or business insurance in Alberta? Start your free quote now—quick, easy, and no obligation.

Make a Payment

Paying your premium is easy. Whether its directly through your insurance company or through us, stay on top of your insurance without the hassle.

Contact Us

Questions? Need to make a change to your policy? Our team is here to help—reach out by phone, email, (support@leducinsurance.com), phone 780-986-8424 or through our contact form.